Featured

Table of Contents

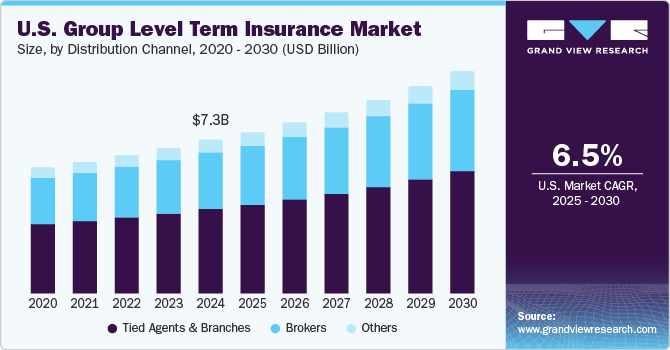

A level term life insurance coverage plan can give you tranquility of mind that the individuals who rely on you will certainly have a death benefit during the years that you are planning to sustain them. It's a means to aid take treatment of them in the future, today. A degree term life insurance coverage (often called level premium term life insurance policy) policy offers protection for a set variety of years (e.g., 10 or 20 years) while maintaining the costs repayments the exact same throughout of the plan.

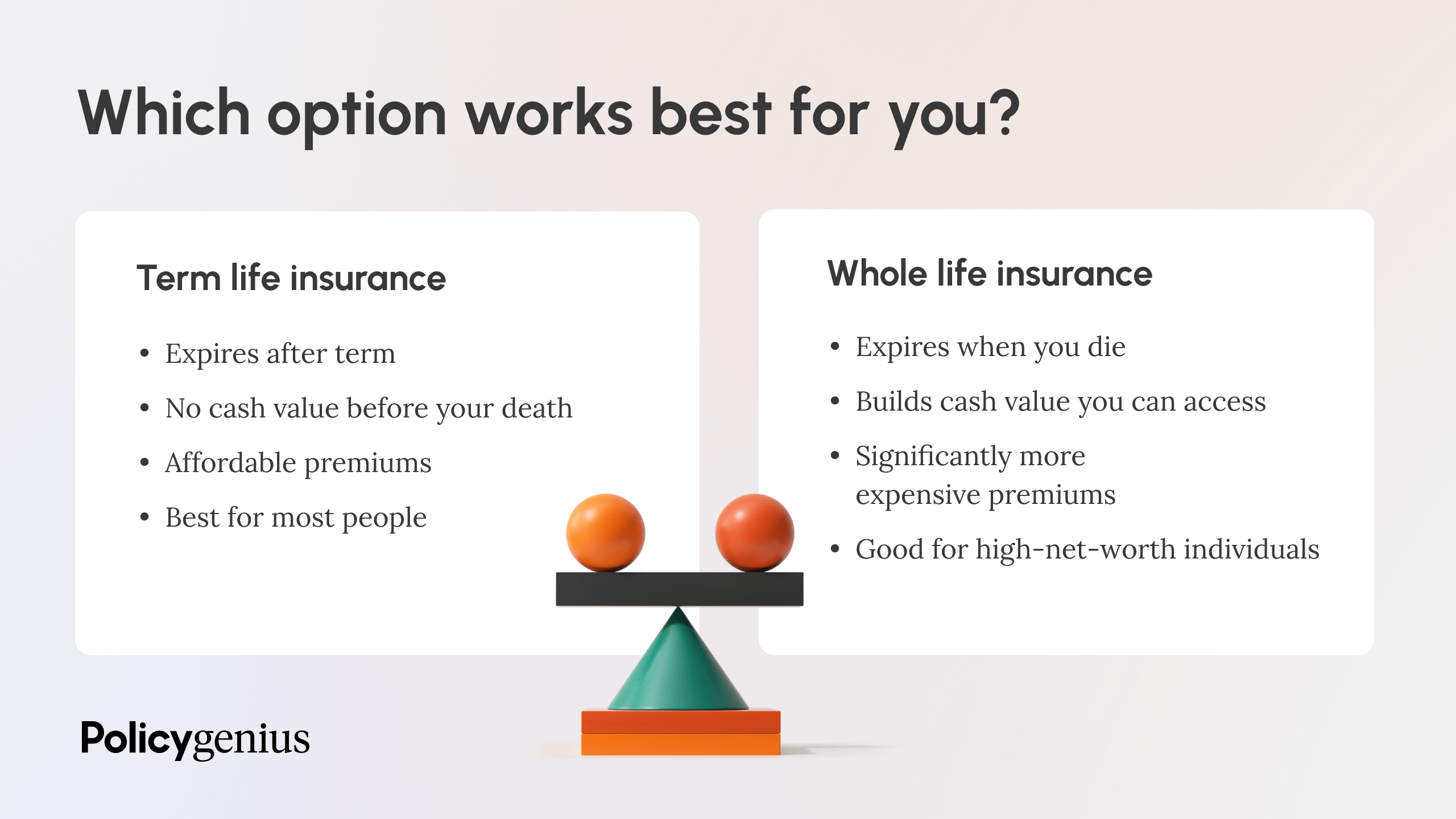

With level term insurance policy, the cost of the insurance will remain the same (or potentially reduce if dividends are paid) over the term of your plan, normally 10 or two decades. Unlike permanent life insurance policy, which never ever expires as long as you pay premiums, a degree term life insurance coverage policy will certainly end at some factor in the future, typically at the end of the duration of your degree term.

Why Term Life Insurance For Couples Is an Essential Choice?

Due to this, many individuals make use of permanent insurance coverage as a secure economic planning device that can serve numerous demands. You might have the ability to convert some, or all, of your term insurance policy during a collection period, usually the initial ten years of your plan, without needing to re-qualify for insurance coverage also if your health and wellness has actually altered.

As it does, you might intend to include in your insurance coverage in the future. When you first get insurance policy, you might have little financial savings and a large mortgage. At some point, your cost savings will certainly expand and your home loan will certainly reduce. As this takes place, you might intend to at some point decrease your survivor benefit or consider converting your term insurance policy to a permanent plan.

So long as you pay your premiums, you can relax easy understanding that your loved ones will certainly receive a survivor benefit if you die throughout the term. Lots of term policies enable you the capability to transform to irreversible insurance coverage without needing to take another health exam. This can permit you to take benefit of the fringe benefits of a permanent policy.

Degree term life insurance coverage is just one of the most convenient courses right into life insurance, we'll discuss the benefits and downsides to ensure that you can select a strategy to fit your needs. Degree term life insurance policy is one of the most usual and fundamental type of term life. When you're searching for momentary life insurance strategies, degree term life insurance coverage is one course that you can go.

You'll load out an application that includes basic personal details such as your name, age, and so on as well as an extra detailed set of questions concerning your medical background.

The short answer is no., for instance, let you have the convenience of death advantages and can build up money worth over time, indicating you'll have a lot more control over your advantages while you're alive.

What is Term Life Insurance With Accidental Death Benefit? Important Insights?

Motorcyclists are optional arrangements contributed to your plan that can give you additional advantages and protections. Cyclists are a terrific means to add safeguards to your policy. Anything can occur throughout your life insurance coverage term, and you wish to be ready for anything. By paying simply a little bit a lot more a month, motorcyclists can give the support you require in instance of an emergency situation.

This rider provides term life insurance policy on your kids through the ages of 18-25. There are instances where these advantages are developed into your plan, yet they can additionally be readily available as a different addition that calls for extra settlement. This biker gives an added fatality advantage to your recipient should you die as the result of a crash.

Latest Posts

What Exactly Does Life Insurance Level Term Offer?

What is Term Life Insurance For Spouse? Key Facts

Riders