Featured

Table of Contents

The rating is as of Aril 1, 2020 and is subject to transform. Sanctuary Life Plus (And Also) is the marketing name for the Plus cyclist, which is consisted of as component of the Place Term policy and provides accessibility to extra solutions and benefits at no price or at a price cut.

Find out much more in this guide. If you rely on a person economically, you could ask yourself if they have a life insurance policy. Learn how to discover out.newsletter-msg-success,. newsletter-msg-error screen: none;.

There are numerous sorts of term life insurance policy plans. As opposed to covering you for your entire life-span like entire life or global life policies, term life insurance policy only covers you for a designated time period. Plan terms normally vary from 10 to thirty years, although shorter and longer terms might be available.

The majority of typically, the policy expires. If you want to maintain coverage, a life insurance provider might supply you the option to restore the policy for an additional term. Or, your insurance firm might enable you to convert your term strategy to a irreversible policy. If you added a return of premium cyclist to your policy, you would get some or all of the cash you paid in costs if you have outlived your term.

Affordable Level Term Life Insurance

Level term life insurance coverage might be the finest choice for those that desire protection for a collection period of time and desire their premiums to remain secure over the term. This may put on consumers worried about the cost of life insurance policy and those that do not desire to alter their fatality benefit.

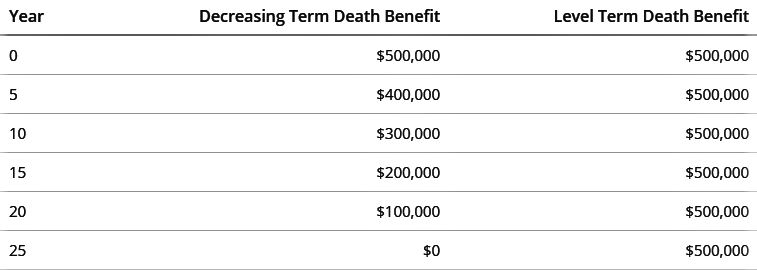

That is because term plans are not ensured to pay out, while irreversible policies are, offered all costs are paid., where the fatality advantage reduces over time.

On the other hand, you might have the ability to secure a less expensive life insurance policy price if you open the plan when you're younger - Level term life insurance. Comparable to advanced age, poor wellness can also make you a riskier (and more costly) candidate permanently insurance. If the condition is well-managed, you might still be able to discover affordable insurance coverage.

Wellness and age are usually much even more impactful premium elements than sex., may lead you to pay even more for life insurance policy. High-risk tasks, like home window cleaning or tree cutting, may also drive up your price of life insurance.

How long does Level Term Life Insurance Vs Whole Life coverage last?

The very first step is to establish what you need the policy for and what your budget is (What is level term life insurance?). When you have a good idea of what you desire, you may intend to contrast quotes and plan offerings from several firms. Some firms provide on-line pricing estimate forever insurance policy, yet lots of need you to get in touch with a representative over the phone or face to face.

The most prominent kind is currently 20-year term. The majority of firms will not offer term insurance to a candidate for a term that ends past his/her 80th birthday. If a policy is "eco-friendly," that means it proceeds in force for an added term or terms, as much as a defined age, even if the wellness of the guaranteed (or other elements) would certainly cause him or her to be rejected if he or she got a new life insurance policy.

Costs for 5-year renewable term can be level for 5 years, then to a new rate mirroring the brand-new age of the insured, and so on every five years. Some longer term plans will certainly ensure that the costs will not enhance throughout the term; others don't make that guarantee, enabling the insurance coverage company to elevate the price during the policy's term.

This suggests that the plan's proprietor has the right to change it into a long-term sort of life insurance policy without additional proof of insurability. In most kinds of term insurance coverage, including property owners and automobile insurance coverage, if you haven't had a claim under the plan by the time it runs out, you obtain no refund of the costs.

What is included in Best Value Level Term Life Insurance coverage?

Some term life insurance policy consumers have been dissatisfied at this outcome, so some insurance firms have actually produced term life with a "return of premium" attribute. The premiums for the insurance policy with this attribute are usually dramatically more than for policies without it, and they usually call for that you maintain the plan effective to its term otherwise you forfeit the return of costs benefit.

Degree term life insurance coverage premiums and fatality advantages continue to be constant throughout the plan term. Degree term plans can last for periods such as 10, 15, 20 or 30 years. Level term life insurance policy is generally extra budget-friendly as it does not construct cash worth. Degree term life insurance policy is just one of the most common sorts of security.

While the names usually are used interchangeably, level term insurance coverage has some crucial differences: the premium and survivor benefit remain the same for the duration of insurance coverage. Level term is a life insurance policy policy where the life insurance coverage premium and survivor benefit remain the same for the period of insurance coverage.

These plans can last for a 10-year term, 15-year term, 20-year term or 30-year term. The length of your insurance coverage period might rely on your age, where you remain in your career and if you have any type of dependents. Like various other sorts of life insurance policy coverage, a level term policy offers your beneficiaries with a fatality benefit that's paid if you pass away throughout your coverage duration.

What is Level Term Life Insurance Vs Whole Life?

That commonly makes them a more inexpensive choice forever insurance coverage. Some term plans might not keep the costs and death benefit the exact same gradually. You don't desire to wrongly think you're buying degree term insurance coverage and after that have your death benefit change later. Many people get life insurance policy protection to assist economically protect their enjoyed ones in situation of their unexpected fatality.

Or you might have the alternative to transform your existing term insurance coverage into a long-term plan that lasts the remainder of your life. Different life insurance policy policies have potential advantages and downsides, so it is very important to recognize each prior to you determine to purchase a policy. There are a number of benefits of term life insurance policy, making it a prominent choice for protection.

Latest Posts

Buy Life Insurance For Burial

Instant Online Life Insurance

Life Insurance Instant Quote