Featured

Table of Contents

If George is diagnosed with a terminal illness throughout the initial policy term, he possibly will not be eligible to restore the plan when it runs out. Some plans supply assured re-insurability (without evidence of insurability), however such attributes come with a greater price. There are several sorts of term life insurance policy.

Generally, most firms provide terms ranging from 10 to thirty years, although a couple of deal 35- and 40-year terms. Level-premium insurance policy has a fixed month-to-month settlement for the life of the plan. A lot of term life insurance coverage has a level costs, and it's the kind we've been referring to in many of this write-up.

Term life insurance policy is appealing to youngsters with kids. Moms and dads can get substantial protection for an affordable, and if the insured passes away while the plan is in result, the household can count on the survivor benefit to replace lost income. These plans are also fit for people with growing households.

Is Term Life Insurance For Spouse the Right Fit for You?

The best option for you will certainly depend upon your requirements. Right here are some things to think about. Term life policies are suitable for individuals who desire significant coverage at an affordable. Individuals who own entire life insurance pay much more in costs for much less coverage but have the safety and security of knowing they are safeguarded forever.

The conversion motorcyclist must allow you to convert to any type of long-term policy the insurance coverage firm uses without restrictions. The primary functions of the rider are preserving the initial health score of the term policy upon conversion (even if you later on have wellness concerns or become uninsurable) and determining when and how much of the coverage to transform.

Of course, general premiums will enhance significantly since whole life insurance is extra pricey than term life insurance. Clinical problems that develop throughout the term life period can not trigger premiums to be enhanced.

What is 30-year Level Term Life Insurance and Why Is It Important?

Entire life insurance comes with substantially higher month-to-month costs. It is indicated to offer insurance coverage for as long as you live.

It depends on their age. Insurance coverage companies set a maximum age limitation for term life insurance policy policies. This is normally 80 to 90 years of ages yet may be higher or reduced relying on the company. The costs also increases with age, so an individual aged 60 or 70 will certainly pay substantially more than somebody decades younger.

Term life is rather similar to automobile insurance policy. It's statistically not likely that you'll need it, and the premiums are cash down the drainpipe if you do not. If the worst takes place, your household will receive the advantages.

What Exactly is Level Term Life Insurance?

For the most part, there are 2 sorts of life insurance coverage plans - either term or long-term strategies or some combination of both. Life insurers supply numerous forms of term strategies and standard life policies as well as "interest sensitive" items which have come to be a lot more common because the 1980's.

Term insurance policy offers defense for a given amount of time. This period can be as brief as one year or provide coverage for a particular number of years such as 5, 10, two decades or to a specified age such as 80 or sometimes as much as the oldest age in the life insurance policy mortality tables.

Why Term Life Insurance With Accelerated Death Benefit Is an Essential Choice?

Presently term insurance prices are extremely affordable and among the most affordable historically experienced. It must be kept in mind that it is a commonly held idea that term insurance coverage is the least pricey pure life insurance policy protection offered. One needs to review the policy terms carefully to determine which term life choices appropriate to meet your specific conditions.

With each brand-new term the costs is raised. The right to renew the policy without proof of insurability is a crucial benefit to you. Or else, the risk you take is that your wellness might weaken and you may be unable to acquire a plan at the very same prices and even whatsoever, leaving you and your recipients without coverage.

You should exercise this choice throughout the conversion period. The size of the conversion period will differ depending on the type of term policy purchased. If you transform within the recommended duration, you are not needed to offer any type of info about your wellness. The premium rate you pay on conversion is typically based upon your "existing achieved age", which is your age on the conversion day.

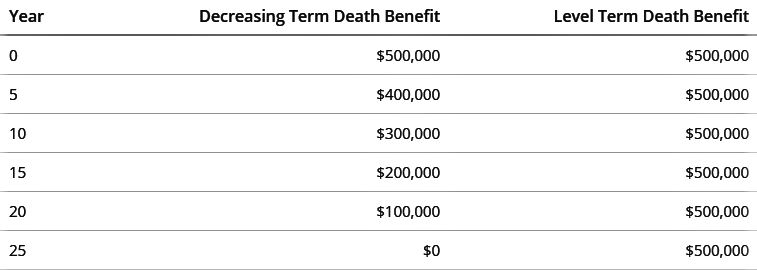

Under a level term plan the face quantity of the plan continues to be the very same for the entire duration. Commonly such policies are offered as mortgage security with the quantity of insurance policy reducing as the balance of the home mortgage decreases.

Typically, insurers have actually not deserved to alter premiums after the plan is sold. Given that such plans may proceed for years, insurers should use traditional mortality, rate of interest and expenditure rate price quotes in the premium estimation. Flexible premium insurance coverage, nevertheless, permits insurance companies to provide insurance coverage at reduced "current" costs based upon much less conventional presumptions with the right to transform these costs in the future.

What Does Term Life Insurance Level Term Mean for You?

While term insurance is developed to offer protection for a specified amount of time, long-term insurance policy is developed to provide coverage for your entire life time. To maintain the premium price level, the premium at the younger ages surpasses the actual expense of security. This added premium builds a reserve (money value) which aids pay for the plan in later years as the price of protection increases above the costs.

Under some plans, premiums are required to be paid for an established variety of years (Simplified term life insurance). Under other plans, costs are paid throughout the policyholder's life time. The insurer spends the excess costs dollars This sort of plan, which is often called money value life insurance coverage, produces a cost savings element. Cash money values are essential to an irreversible life insurance policy plan.

Often, there is no correlation between the dimension of the cash money worth and the premiums paid. It is the cash value of the policy that can be accessed while the insurance holder lives. The Commissioners 1980 Requirement Ordinary Mortality (CSO) is the current table utilized in determining minimum nonforfeiture worths and policy books for common life insurance policies.

What is the Coverage of Term Life Insurance With Accelerated Death Benefit?

Several permanent policies will certainly consist of provisions, which specify these tax obligation demands. There are 2 standard categories of permanent insurance, typical and interest-sensitive, each with a variety of variations. Furthermore, each group is generally readily available in either fixed-dollar or variable kind. Conventional entire life plans are based upon long-lasting price quotes of cost, interest and death.

Latest Posts

How Does Simplified Term Life Insurance Compare to Other Policies?

What Exactly Does Life Insurance Level Term Offer?

What is Term Life Insurance For Spouse? Key Facts